Coming soon to a press release theater near you:

Just when you thought it was safe to get in the iTunes water... dun dun dun!

Forrester Research unleashes a new experience in terror: the paid video download market is a dead end!

(Screams) Only nine percent of online adults have ever paid to download a movie or TV show!

(Screams) The video download market will not grow fast enough!

(Screams) Apple will have to rethink Apple TV!

Jump in line now for the paid research report: “Paid Video Downloads Give Way To Ad Models!”

Only from Forrester Research.

Rated ARRR for piracy themes, broad brushing, and feverish sensationalism.

Are you ready for the latest installment in...

An Epic Franchise of iTunes Horror?

Apple’s iTunes has played the monster in a frightening series of B horror movies. Last year, Paul Thurrott debuted his iTunes Monopoly of Doom, which presented the maniac iTunes as a thief of freedom and an abuser of consumers worldwide:

“If Microsoft can serve as a lesson, and they should,” Thurrott wrote, “Apple should be stopped before the abuses get too great and harm too many consumers. That the US DOJ is publicly defending this company and its practices in Europe is, of course, insane.”

Right before things got too scary, The iTunes Monopoly Myth jumped in like Scooby Doo and pulled the sheet off of the ghost.

It turned out to be a contraption put together by somebody who just doesn't like iTunes very much, and wanted to frame Apple's success as something other than what it was. Oh, Paul.

iTunes Part II: Disaster Strikes!

The second show of that double feature was The Towering Inferno of iTunes Failure. There were some story continuity problems in the sequel, because iTunes was no longer portrayed as an all powerful monopoly, but instead was suddenly a horrific failure that couldn't manage to sell anything.

This epic tragedy was based loosely upon the short story Napster Math. In that tale, iPods were supposed to cost $10,000 for users to fill with songs, because they could hold 10,000 songs, and songs from iTunes cost about 99 cents. That's crazy expensive! Who would ever buy an iPod?

This epic tragedy was based loosely upon the short story Napster Math. In that tale, iPods were supposed to cost $10,000 for users to fill with songs, because they could hold 10,000 songs, and songs from iTunes cost about 99 cents. That's crazy expensive! Who would ever buy an iPod?After iPod sales exploded, the ironic twist was that users weren't spending $10,000 per iPod to listen to music after all. That had to mean, of course, that iPod users were all thieves, and that iTunes itself was a spectacular failure.

At $10,000 per iPod, Apple should have earned at least $1,000,000,000,000 in iTunes revenue by now. What jerks! They haven't even sold a billion dollars of music yet! ...oh wait, no actually iTunes has sold over 2.5 billion songs. But certainly not a trillion.

It turns out that it was all based on a report by Jupiter Research which found the average iPod user in Europe had only bought a mere 20 tracks from iTunes. Jupiter's Mark Mulligan later clarified that the data in his report was taken out of context to fuel sensationalism.

Wait, Stop, Come Back.

This time, the detective was played by Why iTunes Works, which laid out the fact that Apple doesn't have to make any money for iTunes to be a success. In reality, iTunes exists to provide iPod content. It even delivers up lots of content that's free.

Call it a case of mistaken identity: it was really Microsoft's PlayForSure stores that were failing. They all relied upon subscription revenues to keep the lights on, but few customers were interested in paying monthly fees just to listen to music. Most music player users aren't interested in paying for an entirely new library of music, and are happy to listen to the CDs they already own.

As it turns out, there was never any fire raging in the foundation of iTunes; its catalog of music was even expanding into TV shows, providing a popular option to users who don't want to be forced to watch ads. Those users are actually attracted to the feature of being able to watch 90 minutes of programming in just 70 minutes.

iTunes Part III: The Collapse!

A new producer, Andrew Orlowski of the Register, jumped at the chance to deliver his vision for the next installment in the iTunes horror franchise, with The Collapse of iTunes.

Based on ideas from a Forrester Research study, Orlowski reported iTunes sales had actually already collapsed, ushering in the prospect of a socialist paradise where music would be universally site licensed worldwide by convenient taxation.

Before the excited phosphors in Orlowski's web article had even finished glowing, Carl Howe of Blackfriar's Marketing posted a chart illustrating the sales of both the iPod and iTunes and concluded, “The bottom line: anyone who claims sales are collapsing can't do basic math.”

[The Register’s 'Collapsing iTunes Store' Myth]

[Blackfriars' Marketing: Do the math: iTunes sales aren't collapsing]

[Blackfriars' Marketing: Do the math: iTunes sales aren't collapsing]

Bill Gates in iTunes IV: DRM Lock Down.

The disappointing opening of the Register's blockbuster dud Collapse was quickly followed by a fourth installment of iTunes terror, this time featuring a big star: Microsoft's legendary proponent of DRM and all manner of other proprietary technologies, Bill Gates.

It was certainly a surprise to see the architect of Palladium cast in the roll of an Erin Brockovich-style, grassroots critic of DRM. Gates' clumsy performance in a meeting with Michael Arrington and other anti-DRM bloggers was somewhat hard to believe, but did advance the story with some slow moments of flat exposition: today’s DRM “causes too much pain for legitimate buyers” and no one [Apple] has done it right yet, Gates explained.

Apparently, the world needed a superhero with the ability to bend minds around the fact that iTunes' FairPlay DRM is just too painful for the people who willingly choose to use it. No, iTunes' vendor lock has unwitting tied users to Apple technologies. If only there was a way to solve this dire problem with a solution from Microsoft.

Before Gates could explain how, The iTunes Vendor Lock In Myth dropped in from the sky as a deus ex machina.

Apple's DRM is both optional--users are not tied to subscriptions plans and can opt to use their own CDs without touching any DRM--and unlockable--users can burn their iTunes music to CD for use with any other system.

You’re free to go home now Bill. Don’t call us, we’ll call you.

iTunes V: Apple TV and the Dead End of Paid Video.

Now Forrester Research is back, and not just in the supporting role of a B-rated Orlowski-Register disaster flick with a political thriller subplot. Forrester now delivers the next generation of iTunes terror involving Apple TV.

It's not just on your PC. Now it's in your living room.

It’s an entirely new plot: Forrester doesn't continue to claim that iTunes sales are in collapse. That story sank when Apple announced that Forrester’s earlier data was simply in error. This time around, Forrester says that 9% of adults have bought online video downloads and that the market for online video sales will jump from $98 million last year, to an estimated $279 million in 2007.

Wait, that's not good news! It's really all a clever trick. See, 9% is bad because, well, there's no room for growth. Er... those users are just a “niche of media junkies.” As such, they are the vanguard of early adopters, but they certainly “do not represent the vanguard of a rush by mainstream consumers!” And why not?

These exciting plot turns will keep you guessing right up to the end.

Despite growing by nearly 300% in a year, Forrester insists that “the video download market will not grow fast enough to support the ambitions of all the companies involved.”

What companies are involved in online video ambitions? Forrester lists “Apple, Amazon, Microsoft, and Wal-Mart,” which is a long way of saying Apple iTunes and Microsoft PlaysForSure.

Of course, there's no real surprise ending here, because we know PlaysForSure is already dead.

Not even Amazon and Wal-Mart--who could both manage to sell dehydrated water to people who live in house boats--can figure out how to move copies of Microsoft’s PlaysForSure content.

Finding Forrester Through the iTunes.

We already know that Apple owns the majority of the video market, having recently sold 2 million movies. Back in January, Apple announced having sold 50 million TV shows. Nobody else has anything to announce at all.

NPD ranked Apple with a 67% share of the market last year. The two closest competitors are MovieFlix with 19% and CinemaNow in third place with a 9% share. That would leave Amazon, Wal-Mart, and Microsoft’s other PlaysForSure stores with tiny scraps of the remaining 5%. No doubt Forrester Research knows this.

NPD’s online video market share numbers were from the year-long period ending in August 2006. NPD also reported a 39% increase in subscription rentals of TV content, but a 255% increase in TV title digital video downloads. It appears subscriptions rentals aren’t all that hot after all. Somebody tell Microsoft!

Of course, during that period of 2006, Apple had only been selling TV shows, not full length movies. Those iTunes TV shows were also all in the original, lower resolution.

Is it safe to assume that Apple's two million movie sales sold since--and sales of another roughly one million episodes per month of higher-resolution TV shows--have boosted Apple’s market share in online video sales?

When Forrester complains that there's not enough growth in video sales “to go around,” does it intend to imply that there was ever any growth on the part of PlaysForSure partners, who can only offer content that can be played back on devices that are themselves not selling well?

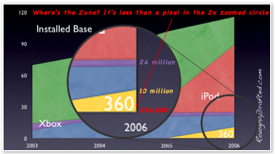

Who would watch these Wal-Mart videos, theoretical Zune users? The limited population of Xbox 360s? The fact that around 40% of the 10 million Xbox 360s that Microsoft has shipped are still sitting in stores unsold may have something to do the limited sales of PlaysForSure movies, too.

Who would watch these Wal-Mart videos, theoretical Zune users? The limited population of Xbox 360s? The fact that around 40% of the 10 million Xbox 360s that Microsoft has shipped are still sitting in stores unsold may have something to do the limited sales of PlaysForSure movies, too. In comparison, there are around 100 million iTunes users.

If Research Happens At Forrester, Is it Sound?

Since we know that Apple owns video downloads in the same manner that it owns music downloads--and has for well over a year--it's a bit hard to swallow the suggestion that the nearly three-fold increase in video downloads estimated for this year will be generated by anyone other than Apple.

That makes it absurd to suggest that it's Apple who needs to rethink its strategy. Recall that Apple sold 1.3 million digital movies before the January unveiling of Apple TV, and continued to sell another 700,000 movies and about 3 million TV shows during the quarter of its release. It was released in the middle of that quarter.

Apple had swift video sales even before it offered a convenient mechanism for watching them. If millions of people were buying videos from Apple to watch on their tiny iPod screen or on their PC, that suggests a healthy market for Apple TV boxes, which make watching those tens of millions of shows and movies far more attractive.

However, after looking at this data, Forrester analyst James McQuivey concluded, “The paid video download market in its current evolutionary state will soon become extinct, despite the fast growth and the millions being spent today.”

Rise of the Advertisements.

So much for survival of the fittest! According to Forrester, Apple TV is a dinosaur and some sort of asteroid is about to ice over the world and kill off Apple TV and perhaps iTunes in a cataclysm of rapid climate change.

“Television and cable networks will shift the bulk of paid downloading to ad-supported streams where they have control of ads and effective audience measurement.” McQuivey wrote. “The movie studios, whose content only makes up a fraction of today’s paid downloads, will put their weight behind subscription models that imitate premium cable channel services.”

TV networks already offer free, ad-supported video content online, but Apple's iTunes is successfully competing with those free downloads. Part of the reason for that is because users don't like to sit through ads.

Those direct video downloads from the networks try to force them to anyway, by not allowing downloads to be played back anywhere but in a web browser. No fast-forwarding allowed!

At what point will iTunes users suddenly decide that sitting through ads from the comfort of the web browser is a better use of their time than buying direct downloads they can watch at their own convenience from Apple TV?

At what point will iTunes users suddenly decide that sitting through ads from the comfort of the web browser is a better use of their time than buying direct downloads they can watch at their own convenience from Apple TV? Is this an all or nothing scenario, where there is no possibility for choice and options?

And You'll Like It!

Forrester seems to think so. “Apple will have to rethink Apple TV, shifting it from a closed pay-per-view system to an ad-supported, broadband service provider model that puts YouTube videos as well as ABC.com TV shows directly on the TV.”

Somebody tell Forrester that YouTube can already be put on TV with Apple TV, as can ABC's TV shows. Why are ads needed for this? Because Forrester doesn't think “mainstream” users will pay for content.

Perhaps the majority of TV watchers won't. Certainly, anyone who pays $100/month for digital HD cable--or roughly $2/hour for their cable or satellite feeds--is unlikely to be interested in paying Apple for it again.

That wouldn't make much sense, particularly since they can already use their Tivo or other DVR to sift through all their channels to grab the shows they want at no additional cost. However, Forrester seems to think that the DVR is going the way of the Dodo as well.

“Streaming of ad-supported TV shows eclipses DVR use by the end of 2008,” Forrester predicted. “Advertisers will cheer because this shift thwarts ad-skipping; consumers will applaud this breakthrough because it’s cheaper than a DVR and is more flexible.”

How is it cheaper to be forced to watch TV with ads as an Internet video stream, compared to watching a show recorded from cable TV using a DVR? How is it more flexible? How does it inspire applause?

The main reason people love their Tivo is because it can skip ads. It won't be applause you hear after you pry the Tivo from users' hands and expect them to watch “streaming TV” laced with ads.

Forrester just doesn't seem to get it.

Imagine the Freedom of Free, with the Addition of Ads!

“New technology such as the recently announced Adobe Media Player will allow consumers to download video for playback without losing the ads that were sold with the video,” McQuivey continued.

Yipee! I hate it when I'm reading a magazine and the ads all fall out. I then have to laboriously collect them for later consideration. Imagine the freedom of a product from the maker of Flash, allowing me to obtain TV with the ads intact. What a lifesaver.

Forrester has somehow been making its living from offering up such research for 23 years now. Well, Forrester, let me introduce Apple. It's been around for over 30 years. It does a fair bit of research too.

Apple vs Forrester: Market Research Rumble.

In fact, Apple spends hundreds of millions more than Forrester on R&D every year. It no doubt ran a few numbers when deciding how to throw together its Apple TV strategy.

Forrester, since you were completely wrong in suggesting that Apple's iTunes sales were in trouble last fall, I'm going to bet against your research suggesting that Apple's ad-free video strategies are also off the mark.

I personally don't want to watch ads interrupting my entertainment, even if Adobe can design a mechanism for forcing me to. Of course, I don't represent the entire world, and I imagine that lots of users will volunteer to struggle with a new generation of bad technology applied to support the unsuccessful business model of forced-view ads subsidizing video content of yet unknown quality.

I think I'd rather sit through an awful horror movie instead, possibly even the dreadful Spiderman 3.

Like reading RoughlyDrafted? Share articles with your friends, link from your blog, and subscribe to my podcast!

Next Articles:

This Series

Haloscan Q107

Forrester Research: Epic Terror of iTunes and Apple TV

Wednesday, May 16, 2007

Ad

Bookmark on Del.icio.us

Bookmark on Del.icio.us Discuss on Reddit

Discuss on Reddit Critically review on NewsTrust

Critically review on NewsTrust Forward to Friends

Forward to Friends

Get RSS Feed

Get RSS Feed Download RSS Widget

Download RSS Widget