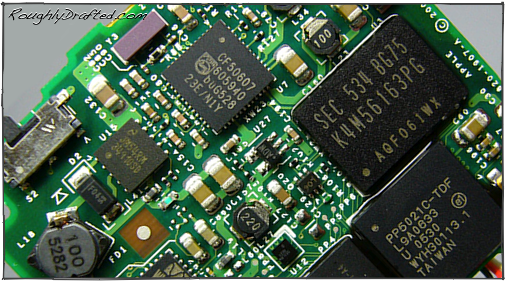

Inside Apple's iPhone

No official details of Apple's iPhone have yet been released, not even its actual name. However, Apple's mobile phone efforts are not just based on the speculative Mac rumor sites known for inventing a large portion of their own content and publishing it as "exclusive information from reliable sources."

Rachel Rosmarin, a technology reporter for Forbes, has written about Apple's mobile efforts, citing both credible sources and noise from such vacuous blurb experts as Rob Enderle. Few facts are available yet, but that doesn't mean there are no clues to examine.

Apple's market position and recent performance suggest the company has the ability, capacity, and interest in shaking up the mobile phone industry, something that service providers, manufacturers, and consumers desperately need. Here's why.

The iTunes Phone

In the tech industry, a lot can happen in a year.

It was just last year that Apple partnered with Cingular and Motorola to introduce a mobile phone capable of playing music from the iTunes Store. Rumors had hinted about the project for nearly a year before it finally appeared in September 2005.

That product was occasionally referred to as an iPhone by the press, although it was neither sold nor designed by the iPod maker. Apple's partners actually referred to it as the “iTunes phone,” because it was simply an existing Motorola phone with limited support for playing FairPlay music purchased through iTunes.

Apple's contribution was to enable the Motorola phone to sync with iTunes; the company also limited its potential by preventing it from storing more than 100 songs at once.

Still, the death of the iTunes phone can be attributed to Motorola's rather boring design; it offered nothing new apart from the ability to play iTunes music.

Dwarfed by the Nano

While Motorola's phone would have died on its own, it was further trampled by customers interested in the iPod Nano, which was introduced at the same event. The Nano offered mobile phone users more capacity and flexibility without needing to get a new phone and a specific service plan.

Like Apple's other iPod offerings, the Nano wasn't just designed to play music from iTunes. It was custom fit into Apple's overall strategy for an iTunes integrated experience; online music sales was just an optional side dish.

Efforts by Sony, Microsoft, and others to build products dependent on online music sales have all been huge failures because online sales aren’t large enough to carry a product, particularly a poor product.

It's no surprise that Motorola's iTunes phone didn't follow the success of the iPod: it didn't copy anything successful about the iPod.

Instead, it attempted to capitalize on Apple's FairPlay DRM, which benefits from--but clearly isn't driving--the iPod's demand.

Convergence and Change

Shortly after the Motorola iTunes phone sputtered out of the starting gate, Jon Rubinstein, then the senior vice president of Apple's iPod Division, made comments in an online German interview that suggested that the idea of convergence in digital devices was overrated.

"It's important to have specialized devices," he said, noting that he believed that the iPod, cell phone, and digital camera would all thrive in individual markets for at least another decade.

Rubinstein has since left Apple. In fact, an awful lot has happened at Apple since then. Following the release of the Nano, Apple sold nearly as many iPods in a single quarter as it had in the previous three: 14 million.

In 2006, Apple introduced and then completed its entire transition to Intel Macs, rocketing Mac sales to record highs. Profits and earnings also blew past expectations, sending Apple's market capitalization from $42 billion to north of $70 billion.

For What It's Worth

Apple as a company is now worth nearly twice as much as it was just a year ago, and almost three times what it was valued back at the highest point of the dotcom bubble in 2000.

Compare that to Microsoft, which enjoyed dynamic growth through the 90s, but like Apple and every other tech stock, peaked out in 2000. Unlike Apple, Microsoft didn't recover from its dotcom losses and has been mostly flat since then. Microsoft has lost the ability to create and develop new markets.

Other tech stocks have similarly failed to create significant new growth comparable to Apple’s since the 2000 crash, as this ten year chart from Google Finance indicates.

The market's valuation of Apple is based on its recent performance as well as its outlook for the future. That's why this month's wavering rumors about the iPhone were able to knock more than $10 off Apple's stock price.

Clearly, the market believes that Apple will be able to maintain dramatic growth, and that sales of new mobile phones will play a significant role in that growth. Nobody is really questioning the appearance of an Apple phone.

Hedge fund number games and misinformation rumors can manipulate the Apple’s stock short term (Jim Cramer explains how), but Apple’s dramatic outperforming of the market over the last three years is no illusion.

Apple's iPhone Calling

iPod, iPhone, iTV: Why Apple's New Platform Works and the followup How article described some of the core benefits Apple can offer in a mobile phone.

Nobody is interested in another Motorola iTunes phone; Apple’s iPhone won't be a phone with music playback tacked on, but rather a phone engineered like an iPod, and sharing its core features and benefits.

Rubinstein's comments on convergence may still apply. Today, Apple sells three very different lines of iPods. The addition of a new phone won't dramatically change the market for players like the Shuffle and Nano.

It's also highly unlikely that a new phone from Apple would incorporate a hard drive, certainly not one as large as the full size iPod. That would indicate that any phone Apple releases would be in addition to its iPod offerings.

Mobile Phones Killed the Radio Star?

Certain analysts like to paint a picture that shows music playing mobile phones eating up iPod sales, but that hasn't proven true over the last several years.

Camera phones are more common--and perhaps more useful--than music playing phones, but that hasn't killed the market for standalone digital cameras, which can do many things camera phones can't.

Camera phones are more common--and perhaps more useful--than music playing phones, but that hasn't killed the market for standalone digital cameras, which can do many things camera phones can't. Similarly, music playback won't just jump into the mobile phone and disappear as a standalone product either.

Actually, music or video playback is the least useful thing Apple could add to a mobile phone of its own. An iPhone with a dock connector and an intelligent, iPod-like user interface would be far more valuable than phones that simply had the ability to play back iTunes music.

Disrupting Service Providers

New hardware isn't the only thing Apple could bring to the mobile world to shake things up. The company has the ability to disrupt the entire distribution channel, which is currently controlled by cellular service providers.

Their control has slowed the advance of hardware features and the emergence of new competition for service. The next article will show how Apple is poised to disrupt the status quo among service providers.

Next Article:

This Series

Monday, December 25, 2006

Bookmark on Del.icio.us

Bookmark on Del.icio.us Discuss on Reddit

Discuss on Reddit Critically review on NewsTrust

Critically review on NewsTrust Forward to Friends

Forward to Friends

Get RSS Feed

Get RSS Feed Download RSS Widget

Download RSS Widget