Apple's iPhone: Disrupting Mobile Service

New hardware isn't the only way Apple can shake things up in the mobile industry. The company has the ability to disrupt the entire distribution channel, which is currently controlled by cellular service providers.

The control maintained by service providers has slowed the advance of hardware features and the emergence of new competition for service. Here’s how Apple is poised to disrupt that status quo.

The Phone Subsidy Illusion

Conventional wisdom in the cell phone industry says it's too hard to sell phones at full retail, because most customers can't afford to pay several hundred dollars for a new phone.

Service providers also don’t want to compete for customers on a monthly basis; finding new customers or getting rivals' subscribers to switch is expensive and difficult.

They solve both problems by creating the illusion for users that phones are free or very cheap, and tie subsidized phone sales to extended contracts. That ensures customers can't leave for a year or two, at which time the phone is expected to be obsolete and the customer is expected to be ready to sign a new phone contract.

The High Cost of Low Prices

As an example, Palm's Treo phones would cost $600-700 at retail, a high price tag most customers would have to consider carefully. Phone providers offer the same phone for as little a $50 with a contract. Whoopee! Of course, providers don’t give away over $500 in hardware to be charitable.

As an example, Palm's Treo phones would cost $600-700 at retail, a high price tag most customers would have to consider carefully. Phone providers offer the same phone for as little a $50 with a contract. Whoopee! Of course, providers don’t give away over $500 in hardware to be charitable. That heavy subsidy is paid back over the life of the contract, which typically starts around $50 per month. It is pushed up by service providers, who work valiantly to add in extra fees for text messaging, email, web, and any other services they can invent: De Luxe Voice Mail Pampering, etc.

At $50 per month, a two year contract is worth $1200. That makes it easy for providers to subsidize expensive phones, if those phones can draw in new customers or create opportunities for new fees, such as photo emails and web access.

That business model leaves little room for anyone to consider buying the phone they want at retail without a service plan rebate. Subsequently, hardware sales all trickle through service providers, who demand that phones serve their own interests, not customers. Everything is designed to sell more minutes and fees.

Arrested Hardware Development

Phone manufacturers currently rely on service providers to sell their phones for them. Service providers only care about hardware features that either sell new contracts or increase minute use.

Phone makers often can't offer features in the customer's interests because the middleman--the service provider--doesn't want customers to do anything that might decrease their minute use.

Bluetooth wireless is one example: it allows phones to download pictures and sync data with a PC. Service providers would prefer that customers use mobile networks to sync data to company servers and send their photos directly to other users via their phone.

Some providers, notoriously Verizon, have even disabled Bluetooth features on phones they sell. Verizon even went beyond Bluetooth to kill the cable, by infecting the Palm Treo phones they sell with horrible, buggy software designed to sync with their server over the mobile network rather than the user’s PC via standard Palm HotSync.

Another threat to service providers is WiFi wireless: if customers could place VoIP calls over their own wireless Internet, cellular service providers would lose the ability to charge for all those minutes, anywhere that the increasingly common wireless Internet service is available.

Another threat to service providers is WiFi wireless: if customers could place VoIP calls over their own wireless Internet, cellular service providers would lose the ability to charge for all those minutes, anywhere that the increasingly common wireless Internet service is available. It's not hard to see why WiFi features haven't gained any traction in mobile phones. Customers who want these services can’t buy them; hardware makers who would be happy to sell these services can’t market them. In both cases, the service providers are working to preventing free markets from functioning.

This All Happened Before

This situation has parallels in the past. The first is time share computing: it was once thought that computers would always be huge devices that consumed an entire room, and users would all pay fees to access them. This model was broken up by the personal computer, a device end users bought and used without ongoing fees.

A second example is the old phone company. Not too long ago, Ma Bell rented landline phones to everyone in the US. Back then, the phone company wanted to charge a extra monthly fee for the "service" of a light that blinked when the telephone rang, and also expected customers to pay to rent centralized call answering services.

After that monopoly was dismantled, users could buy any phone they wanted. The resulting market created a wide variety of landline phone options, including many with cordless and answering machine features that required no ongoing fees.

One last example is Bill Gates’ vision of a future where everyone rented software. That never happened. The vast majority of users want to buy software and own it, not rent access for an ongoing fee. The same applies to music.

Sell Different

The market disrupted time share computing and telephone monopolies by offering users the ability to buy what they wanted, rather than locking them into forced subscription models that limited their options.

Today's mobile market is similarly stuck under the thumb of mobile service providers. Apple can bust that hold by disrupting how mobiles are sold. For starters, Apple has something that most other phone makers do not: lots of retail stores.

Apple's stores are not only prepared to sell complex tech products, but they are full of shoppers ready to pay hundreds of dollars for the hardware they want. Those shoppers will not freak out at the prospect of buying a $400 smartphone.

Service and Support

Apple also has online sales and support for its existing products, so adding phone sales and support is no stretch. It already sells service plans with Dot Mac, ProCare, and AppleCare.

Apple is a hardware, retail, and service powerhouse with the capacity to shift entire models of how products are sold.

Other computer retailers have struggled to run their own retail store efforts, including Gateway, Dell and Sony.

Other phone manufacturers are similarly lost. Palm recently opened a few boutique stores that are perpetually empty, and has taken to putting sales people on Segways to hand out fliers in downtown San Francisco.

Mobile service providers spend a lot to maintain retail stores selling free phones tied to service plans. Apple can simply add phones to its existing stores, sell new hardware, and support it with service, something few others have the opportunity, capacity, or interest in doing.

Mobile Virtual Network Operator

By selling the phone hardware direct to its loyal customer base, Apple wouldn't have to tie them into long term contracts. That means Apple could sell both prepaid calling cards as well as minute service plans as a MVNO: buying minutes in bulk from carriers, then reselling the minutes to its iPhone customers.

Existing MVNOs, including Virgin Mobile, sell prepaid calling plans to students and people who lack credit. Apple could easily dominate that market. Further, the volume of iPhone sales sold at retail will allow Apple to resell a significant chunk of ongoing minutes, enabling it to offer competitive service rates.

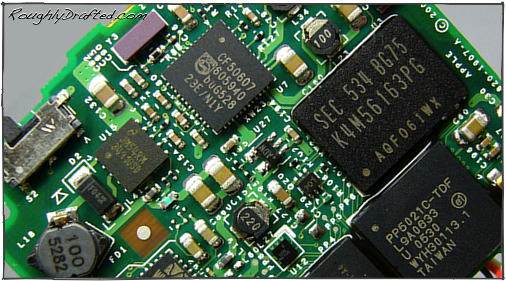

Because Apple typically makes its money from hardware, it wouldn't need to block features such as Bluetooth and WiFi, or push worthless subscription services for TV clips and the AOL-like content that cellular service providers are now trying to foist on their subscribers. Apple already has real content lined up in iTunes.

Apple could afford to integrate Internet and VoIP services, giving customers a much better product at a better price than any existing combination of hardware maker and service provider can provide.

Just like iPod

Essentially, Apple would be acting in the same role it took with the iPod: selling premium hardware with free integrated software and low cost content services that serve to distinguish it as a product and eviscerate competing efforts to flog overpriced subscription fees.

Just as Apple taught the RIAA how to make money online with fair DRM and consistent pricing, it's also in the position to show service providers how to sell minutes without inflating prices and denying customers the ability to use their own hardware.

Other hardware providers, including Palm and Microsoft's WinCE hardware partners, are at the mercy of network operators, giving them no leverage to fix the problems that service providers have created.

A Phone Software Market

Phone manufacturers are also struggling to deliver a smartphone that works well. Software for Palm and WinCE phones is relatively expensive; Apple has pioneered selling games for the iPod for $4.99, which would typically cost closer to $15-20 on the Palm. Other phones are fractured between J2ME, BREW, and custom platforms.

The same iTunes mechanism for selling iPod games can be used to distribute and sell custom software for a new Apple iPhone, creating a large market for specialized phone software, including web services applications:

-

•GoogleEarth mapping and directions using the phone for GPS

-

•Sophisticated voicemail, text, and email integration for universal messaging

-

•Localized news and information services

-

•Tools for presenting camcorder, podcast, and iTS video on an external display

Apple may announce its new mobile phone next to the iTV as early MacWorld, and make them both available in the first quarter. It may also offer limited messaging or network services in the standard iPod, similar to those described in Generation 6 iPods.

The new phone will probably not work with every provider; I'm hoping for a GSM based world phone that would allow Apple to bring the smart chip market common in Europe to the US. Apple is already a partner in GSM technologies, having worked to integrate 3GPP into Quicktime.

This would greatly simplify Apple's design efforts, allowing the company to focus on a single type of technology and act as the main service provider for its customers. Outside the US, it is already common to sell unlocked phones that can be used with any provider; Apple could popularize that business model here.

Of course, a standard GSM phone would also work over the networks of US providers such as Cingular, TMobile, and Metro PCS, and those providers would likely offer rebates to iPhone buyers to get them to sign contracts for their service plans.

Apple’s Next Step

Apple's position as a hardware maker with retail stores and software expertise allows it opportunities unrivaled by other phone makers like Motorola, software middleware providers such as Microsoft, and services providers that simply resell subsidized phones in an effort to sell minutes.

In 2007, Apple has the capacity to flip the entire mobile world on its head, with the same quiet speed it has used to reinvent itself as a specialized Intel PC maker. It will be fun to watch.

Next Article:

This Series

Tuesday, December 26, 2006

Bookmark on Del.icio.us

Bookmark on Del.icio.us Discuss on Reddit

Discuss on Reddit Critically review on NewsTrust

Critically review on NewsTrust Forward to Friends

Forward to Friends

Get RSS Feed

Get RSS Feed Download RSS Widget

Download RSS Widget