Smartphones: iPhone and the Big Fat Mobile Industry

When comparing the iPhone to the Motorola Q, a consideration of the subsidies provided by mobile providers and the expense of contracts helps to illustrate why it's both pointless and misleading to talk about mobile phone prices without any context.

The market for mobile phones also varies considerably, from basic mass market phones that do little beyond placing calls, to the ultra high end, where phones will soon slice bread and then toast it with a retractable Swiss Army magnifying glass.

Here’s a look at the mobile industry at large, and smartphones in particular, and how Apple plans to enter the already crowded market with its new iPhone.

The Big Fat Mobile Industry

At the end of 2005, there were over 2 billion mobile subscribers worldwide, compared to only 1.2 billion fixed landline phones. During 2005, mobile phones accounted for half of the world's telecommunications service revenues, and 40% of the world's telecom equipment sales.

The mobile phone market dwarfs the volume of other consumer electronics. For 2005 IDC reported sales of:

-

•93.8 million digital cameras

-

•102.7 million portable games consoles

-

•208.6 million desktop and laptop computers

-

•825.4 million mobile phones

The 825 million phones sold in 2005 indicate that more than a third of all existing subscribers bought a new phone within the year. In 2006, an estimated 930 million phones were sold, an increase of around 12%. In 2004, sales hit 707 million phones; in 2007, over a billion phones will be sold.

That's a steady expansion of over 100 million additional phones every year. Much of the unit growth is happening in emerging markets, where entry level mobile phones are cheaper than installing a fixed phone line.

In the US, Europe, and Japan, growth is appearing in phone sophistication; an increasing number of the nearly one billion phones sold each year now fit the description of smartphones. The US only just catching up to the rest of the developed world in the adoption of smartphones and the faster mobile networks that support them.

What Exactly is a Smartphone?

Research groups all seem to use slightly different definitions of smartphone; some include all PDA phones, others only count phones where voice is the primary use, and exclude PDAs with voice features tacked on, such as WinCE based Pocket PCs.

Since those PDA sales hardly amount to anything, the discrepancies are not very important. Of the 825 million phones sold in 2005, IDC counted 57 million as smartphones. Figures from Strategy Analytics and Canalys reported closer to 45 million.

However, all tend to agree that smartphones are where the growth is. IDC says smartphones are growing at a rate of more than 46% each year, compared to standard mobile growth of 21%. IDC predicts smartphones to account for 250 million units by the end of 2010, while Strategy Analytics estimates 300 million.

Microsoft’s Unique Definition of Smartphone

Incidentally, Microsoft uses “Windows Smartphone” to refer only to its simplest Windows Mobile products without a touch screen, such as the Motorola Q. These devices have tiny screens, a mini phone keyboard, and are generally designed for one handed use.

More complex devices with Palm-like PDA features, including touch screens, are given the “Pocket PC” name. Both are Windows Mobile, which itself is a subset of WinCE.

Until just recently, the two types of Windows Mobile devices were actually very different platforms; applications have to be specifically written for each device, and each used a different version of Windows Mobile / WinCE 4: “Windows Mobile for Smartphones 2003” or “Windows Mobile for Pocket PC 2003.”

In Windows Mobile 5.0 / WinCE 5, which just shipped in November of 2006, the OS difference between Windows Smartphones and Pocket PC blurred. Rather than shipping each as a very different package, Microsoft now has one OS that can be optimized for both sets of devices by disabling features that are not available or supported.

Windows Mobile software still has to be optimized for the target device. Efforts to accommodate different form factors have resulted in a complex and confusing set of sub-platforms typical of Microsoft’s other software efforts. As a result, Microsoft makes limited efforts to support earlier devices in its new versions of Window Mobile.

Existing Smartphone Market Share

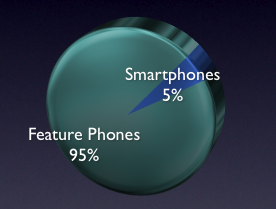

While the top five vendors--Nokia, Motorola, Samsung, LG, and Sony Ericsson--all sell a broad array of phones from cheap to fancy, Apple has only targeted the smartphone market, which just over 5% of all mobile phones.

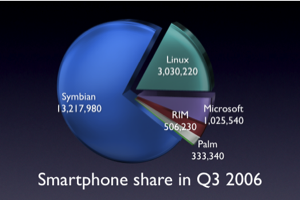

The market share for smartphones is commonly reported by the OS running the phone. In September 2006, Todd Kort, a principal research analyst for Gartner, Inc., reported market share for smartphone mobiles in Q2 2006:

"Symbian accounted for about 71 percent of worldwide smartphone shipments in the second quarter of 2006 and serves the consumer market well. Microsoft, Palm, and [Blackberry maker] RIM each accounted for only about 3 percent of smartphone shipments in the second quarter, with Linux accounting for the remaining 19 percent."

Depending on who’s counting and when, the numbers fluctuate, but not by much. Canalys, reporting on Q3 2006, similarly gave Symbian 72.8%, Linux 16.7%, Microsoft 5.6%, RIM 2.8%, and Palm 1.8%.

Compared to the year before, Canalys reported that Linux units (which includes the closed, Linux-based phones sold in Asia) held steady, Symbian units increased by 62%, sales by Microsoft more than doubled from 2.2%, Blackberry sales nearly doubled from 1.5%, and Palm unit sales plunged by nearly half, from 4.5%.

Palm’s Loss is Windows’ Gain

Palm's losses represent fewer units of its Palm OS based phones; Palm Treo hardware sales haven't gone away, but a good chunk of Palm's Treo sales have converted to Windows Mobile. That means that a large portion of Microsoft's Windows Mobile growth has come from Palm's adoption of Windows Mobile software.

In 2006, Palm introduced new Treo models using Windows Mobile exclusively and only shipped the Palm OS version later, encouraging early adopters to migrate away from its own operating system. Clearly, Palm is one genius company. It’s no wonder Palm’s CEO thought Apple could never understand the mobile phone business.

The Real Growth in Smartphones

As Windows Mobile eats up Palm’s tiny remaining slice, Symbian’s majority share has remained unchallenged. IDC analyst Andrew Brown estimated that Symbian will maintain a 65% share of the market in 2010.

That leaves Symbian's rivals with a minority of the smartphone market to squabble over, much like the music player market, where competitors all fight over the remaining quarter not held by Apple's iPod. The music player pie chart looks almost identical.

The fastest growing smartphone manufacturer is Motorola. Gartner reported that the company’s shipments more than doubled in the first half of 2006, due to sales of Linux-based phones in China. The same report pointed out that Motorola's Windows Mobile and Symbian based phones “had relatively lackluster success.”

Steve Jobs and the Insane 1% Mobile Plan

In his Macworld Expo keynote presentation, CEO Steve Jobs announced that Apple planned to take just 1% of the billion unit mobile phone market, and charmed his audience into thinking that this would be relatively easy.

What he failed to mention is that the vast majority of the mobile market--around 95%--is made up of cheap units euphemistically described as “feature phones.”

Symbian's 72% majority share of the smartphone market amounted to around 50 million phones in 2006. That means ten million iPhones sold by the end of 2008 would grab a fairly large portion of the relatively small smartphone market.

Apple may be shooting for 1% of the "mobile market," but it really intends to capture closer to 15% of the smartphone market--more than Palm, RIM, and Windows Mobile combined--in its first year.

Does Apple plan to steal sales from existing smartphone makers, or does it have in mind upgrading users of basic phones to the new, more powerful iPhone? It seems pretty clear the company would have to do a lot of both to meet that aggressive target.

Apple and Microsoft: Reversal of Fortune

By way of comparison, Apple's target would be very close to Microsoft announcing plans to sell 10 million Zunes by the middle of 2008, but describing the goal as "just 2% of the market for all consumer electronic devices and computers."

Microsoft only plans to ship one million Zune units by the middle of 2007. Based on existing Zune sales reports, the only way Microsoft could meet that goal is to stuff the sales channel with inventory, just as it did with the Xbox 360 this winter, to give the impression that “10 million shipped” is the same as that many actually sold.

That’s what the old Apple tried to do in the mid 90s: stuff inventory into the channel to create the impression that its Macs were selling faster than they actually were. The plan backfired, resulting in a huge inventory of machines that became obsolete while sitting in warehouses.

Microsoft is increasing looking like the Apple of 1996, in an alternative world where there is no NeXT Inc. poised to reach down and rescue the faltering company from itself.

But what about Apple? How does the iPhone compare against popular phones already on sale? The next article will take a look.

Next Articles:

This Series

|

|

|

|

Del.icio.us |

Del.icio.us |

Technorati |

About RDM :

:

Technorati |

About RDM :

:

Sunday, January 21, 2007

Send Link

Send Link Reddit

Reddit NewsTrust

NewsTrust