Why Apple Bounced Back

Why Apple Failed promised to reveal an accidental discovery that was key to Apple's recovery. The great minds of Slashdot took various guesses over the weekend, but here's the real reason Apple was able to create new growth in the Mac platform.

Why Apple Bounced Back: Software

As noted in The Rise and Fall of Platforms: Planting Software Seeds, Apple had observed how Adobe's PostScript technology had driven the development of desktop publishing as a killer application for the Mac, and hoped to similarly deliver the basis of a new wave of multimedia applications using its own QuickTime software.

QuickTime not only drove adoption of Macs, but it preserved the Mac platform through the 90s by helping to establish it in the field of content creation.

Why Apple Failed described how Apple was at the mercy of its developers, and particularly the four majors: Microsoft, Adobe, Macromedia, and Quark. All four had originally established their graphic applications on the Mac, but were moving toward Windows.

Windows itself was the result of Microsoft seeking to broaden its sales of Word and Excel from the Mac onto DOS PCs. As Windows gained adoption, it created a huge potential market for graphic applications that had only ever been available on the Mac. Developers naturally followed Microsoft to reach that huge new market.

The Cross Platform Threat

Adobe, Quark, Macromedia and other Mac developers built their own in-house cross-platform development systems to allow them to deploy versions of their software on both Windows and the Mac.

This new style of "lowest common denominator" cross platform development resulted in Apple's customers having fewer reasons to stick with the Mac platform. Apple could invent all sorts of new software technologies, but if these features complicated developer's cross-platform efforts, they simply wouldn't ever get adopted.

This helped to kill any value remaining in developments like PowerTalk and QuickDraw GX. Adoption of new Apple features would add value to Macs, but didn't do anything for developers apart from making their work harder.

Third party developers weren't anti-Mac; they were simply acting in their own best interests.

The same situation has also threatened Microsoft and other platform vendors; both Sun's Java and Netscape's web platform threatened to create software that worked anywhere, which would erase any differentiation or value from Windows as a platform. Microsoft worked hard to stop them.

DIY Software

Apple needed to differentiate the Mac platform with innovative software applications, but it increasingly had less and less power to do so, as big developers ignored its unique features and toolkits.

If Apple wanted unique applications for its Mac platform, it would have learn how to deliver them itself. There was a huge risk involved: it seemed impossibly difficult to create software without angering third party developers.

Prior to the Mac, Apple had shipped its 1983 Lisa computer with a full suite of Apple designed office software. The Lisa's commercial failure was partly attributed to the perceived lack of opportunity for third party developers.

Realizing the importance of a healthy third party development ecosystem, Apple determined not to repeat the same mistake with the Macintosh.

When Apple released the Mac, it only shipped it with the simple MacWrite and MacPaint applications, which were supposed to serve as placeholder demonstrations.

However, third party developers were still annoyed that these Apple titles limited the potential market for retail software. To placate these developers, Apple spun off its internally developed Mac software into a new Claris subsidiary in 1987.

Claris later acquired the developer of the FileMaker and rebranded its various software titles with a common Claris look. It eventually became Apple policy that all application software would be handled by Claris.

By the time NeXT arrived to reinvent Apple a decade later, the once innovative Claris software portfolio was largely dead, apart from its basic ClarisWorks suite and the popular FileMaker Pro.

The new Apple renamed Claris to FileMaker, Inc. and scraped the remains, apart from ClarisWorks, which Apple itself began to sell under the name AppleWorks.

After a decade of pointedly avoiding application software, Apple was now back in the development business, even if it didn't yet realize how important that would be to the Mac’s recovery.

Apple Strikes Gold with KeyGrip

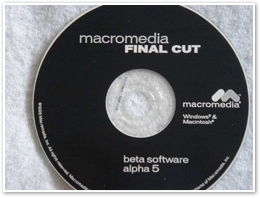

In the same late 90s timeframe, Macromedia hired the development team of Adobe's Premier, lead by Randy Ubillos, in order to develop a rival new professional level video editing application based on QuickTime. The product was tentatively called KeyGrip and then Final Cut.

Shortly after starting work on its "Premier killer," Macromedia decided to stop competing directly with Adobe. Instead, it would target the market for web development tools, and leave the video and print markets to Adobe. Macromedia put the unfinished project up for sale, but couldn't find a buyer.

Apple bought the product from Macromedia in 1998 to prevent it from simply being abandoned. After being unable to find a developer interested in continuing work on it, Apple completed the project itself, releasing it the next year as Final Cut Pro.

What began as a fortunate accident would become Apple's new killer app for the Mac.

Final Cut Pro Cleans Up

Final Cut Pro quickly destroyed Adobe's Premier. Apple's new product was essentially an entirely reworked new version of Premier, while Adobe had let its Premier languish as it focused on graphic design and print production.

The desktop market for video editing was still small, so the challenge hardly mattered. It was an easy victory. Apple really broke ground with Final Cut Pro when it took on industry leader Avid.

Avid started out on the original Macintosh II in the late 80s, and had since become the leading vendor in delivering video editing workstations. Initially, Final Cut Pro wasn't seen as much of a threat. The film industry was strongly entrenched behind Avid solutions, and Final Cut Pro only offered a limited subset of its features.

What Final Cut Pro did offer was easy access to the power of QuickTime. It allowed both large and small studios to set up a relatively inexpensive Mac to do their simple post production tasks at much lower cost than if they were to tie up their own Avid, or have to rent access to an expensive Avid studio.

After allowing Apple an entry into professional post production and broadcast graphics, Final Cut Pro has been able to grow into a serious competitor.

The Turnaround Discovery

Final Cut Pro was a great demonstration of the flexibility of Quicktime, and importantly for Apple, distinguished the Mac platform. Apple had canned the development of Final Cut for Windows, making Mac hardware the only way to run Final Cut Pro.

The new Apple suddenly discovered that the way to sell more Macs was to offer compelling new software that was only available on the Mac. This might seem obvious in retrospect, but the company had been cautiously avoiding the application software market for over a decade. Claris had even ported FileMaker to Windows.

The initial worry that bundled software would chill third party development had been overwhelmed by the much greater fear that the Mac would cease to matter unless Apple differentiated its platform with unique software, something that the big third party software developers saw no need to do.

Apple's Software Explosion

Hot off the heels of Final Cut Pro's emerging success as a new Mac application, the new Apple went on a buying frenzy to acquire other strategic software projects and their development teams.

In 2000, Apple bought DVDirector and the DVD technology portfolio from Astarte GmBH, and hired its entire development team. It released the product the next year as DVD Studio Pro.

Combined with Final Cut Pro, it supported an emerging new market of pro, freelance, and small corporate film studios producing their own DVDs.

In addition to professional level applications, Apple released iMovie in 2000 as a simple consumer version of its video editor, followed by iTunes and iDVD in 2001, and iPhoto in 2002. Apple bundled all these applications with new Macs for free.

Suddenly users had compelling new reason to buy a Mac over a PC: Macs came bundled with a lot of unique software that just worked. It would cost a couple hundred bucks to assemble a similar suite from third party Windows developers. That effectively erased the price advantage held by cheaper, low-end PC makers.

In 2002, Apple acquired the high end video compositing software Shake in its purchase of Nothing Real, and then bought Emagic, a German software developer of professional level music studio tools.

Apple shocked analysts by dumping the Windows version of both Shake and Logic, and releasing new versions as Mac OS X only.

In 2003, Apple bundled its consumer applications into a package called iLife, and began selling the new product for $49, or about $15 per application. It also launched Keynote, a new presentation application, as well as a new prosumer version of Final Cut Pro branded as Express.

The following year, Apple included a new consumer version of its music software as GarageBand, and a prosumer version called Logic Express. Apple also released Motion as a new motion graphics application.

The following year, Apple included a new consumer version of its music software as GarageBand, and a prosumer version called Logic Express. Apple also released Motion as a new motion graphics application. In 2005, Apple launched Pages, which it bundled with Keynote to create a new business suite called iWork. Apple refers to iWork as the 'in progress successor' to AppleWorks.

Later in the year it introduced Aperture as a new pro photography post production tool; earlier this year Apple added the iWeb to the iLife 06 suite.

Low Profit, High Value Software

From avoiding any software development at all under the Apple name, to becoming a significant developer of professional studio software, prosumer tools and two consumer suites, Apple clearly landed at the conclusion that it needed to deliver its own software or watch its Mac platform shrink into obscurity.

Apple didn't convert from a hardware company into a software developer however. It continued to bundle iLife for free, and priced its retail versions of iWork and iLife at $79.

At $15-40 per application, that leaves Apple's consumer offerings in the price range of shareware. Clearly, Apple isn't making huge revenues from developing consumer software.

It's also not hard to understand why there is little competition in the market for personal content creation tools: there's little profit.

Charging for annual updates allows Apple to follow the Notable Platform Lesson of incrementally advancing applications with regular, significant updates, creating real value for users and adding real value and differentiation to the Mac.

Selling Hardware with Software

Apple also released new hardware designed to exploit these software applications. Apple added Firewire to all Macs especially for digital video work, and has updated its latest machines to all use optical digital audio ports; few PCs offer either, particularly not in consumer models.

By building its own hardware, operating system, and application software, Apple can release new technologies and implement them at the same time, rather than simply wish that third party developers would adopt them, as the company did in the early 90's.

For example, Apple added Audio Units to Mac OS X as standardized plugins for audio processing, and later added support for them in Logic and GarageBand. Apple also created Image Units for Mac OS X’s CoreImage, and used the technology to deliver Aperture.

If Apple had left Aperture for Adobe to develop, it is unlikely Apple's Mac specific technologies would have been incorporated, because Adobe would have to replicate Apple's technology to make it also run on Windows. By shipping its own product, Apple can tune the best performance from its hardware offerings and deliver a better product for its customers.

The Suite Deal

Just as Microsoft compiled an office suite, and integrated it into its email server, server software, other back-end server tools, and development tools, Apple is pursuing similar integration, although Apple can also include specialized hardware into the mix.

For example, while some analysts seem to think Apple's Xserve RAID is a blindly speculative entry into the Enterprise market, the most obvious application is by Final Cut Studio users who are dealing with enormous amounts of HD video content.

Similarly, Apple's 30" displays aren't a dance with Dell into the market for crazy high end gamers, but a product carefully targeted toward pro and prosumer users of Aperture and Final Cut Studio applications.

Apple has tightly integrated its product lines together in many ways, creating new applications and simplifying things for users. For example, Apple's iPod gains much of its simplicity through its tight integration with iTunes.

Apple later integrated iTunes with its wireless products to introduce AirTunes streaming. Next year's iTV promises to do the same for video. It’s also tightly integrated with Apple's WebObjects based online store, and serves as a central catalog for music, podcasts and video clips which can then be used in iLife applications and shared wirelessly with other users.

NeXT's resuscitation saved Apple, but its the software that has given new potential users a reason to buy Macs. Still, there's other key reasons behind Apple's recovery.

This Series

Wednesday, October 25, 2006

Bookmark on Del.icio.us

Bookmark on Del.icio.us Discuss on Reddit

Discuss on Reddit Critically review on NewsTrust

Critically review on NewsTrust Forward to Friends

Forward to Friends

Get RSS Feed

Get RSS Feed Download RSS Widget

Download RSS Widget